The debt-to-equity ratio is a well-known term. It is the amount used for measuring the financial health of a person or a company. Moreover, it helps to check out the capital where all the assets, liabilities, expenses, and equity are kept in mind. It is more about the liabilities and the debts of a person that shows the person has a high debt to equity ratio. On this the company’s future and a person’s loan depend.

For example, when you are applying for a loan one of the most important things financial institutions check is the debt to income ratio. If the ratio is more then it means the company or any person is managing the debts. The financial health is very weak and the cash flow is less. We can say that in simpler words it is almost a hand-to-mouth situation. When a company is in such a crisis, then taking the advantage of this leverage, investors invest.

But in the time when a person needs a loan bank won’t approve the file because of the debts. A low ratio shows that there is cash flow and there is capital.

Debt-to-equity ratio examples:

Alan is an investor who wants to buy a company or want to invest in. He sees that there are two leather-making companies one that has a 67% debt to income ratio and one that has 35%. When the investor will take the decision he will go for the first one as they know that such a company is in debt and will need more help and there will be more returns in the future there.

On the other hand, when it comes to the loan, the situation is the opposite. The bank chooses people with less ratios not high like the above example.

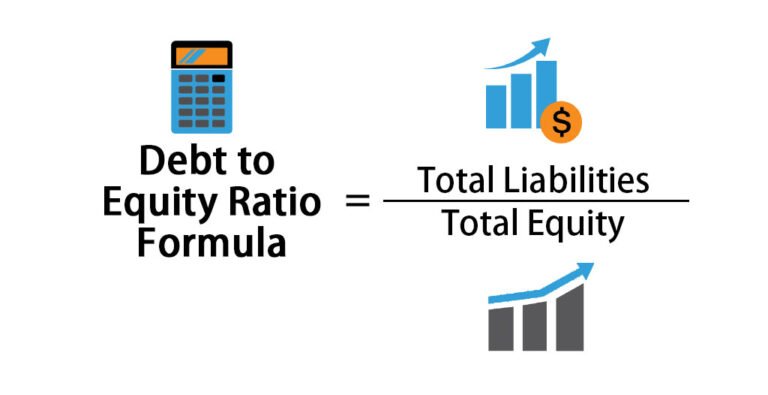

What is the debt to equity ratio formula?

Here is how you will calculate using the debt to equity ratio formula:

(Long-term debt + Short-term debt + Leases) ÷ Equity

To calculate this is the formula that is used around the world. It gives you the overall ratio of how much a person is in debt. There are of course certain points in this calculation. Like you have to include all things even your bonds, assets, credit history, and everything financial related to you.

Debt to equity ratio problems:

It is quite helpful but sometimes in some rare cases, the situation is wrong. For example, if someone has bought a large amount of stock, that is a different case and we cannot say that due to no cash flow he/she has a large amount of debt. There are certain impacts but the debt is the main reason why in every financial decision the capital is checked.

Good debt to equity ratio:

Debt to equity ratio like we discussed in the above situation is depending upon the cases. Like investors invest in the high ratio. But if we talk about an overall situation, the good debt is the one which is a low ratio. In any case, the main thing or the goal is to check the ratio of the debt. And, the formula shows it. No matter which decision anyone takes, the plan is different for everyone.

Even if the debt is high the person should be able to pay it off. Therefore, there is a checking of the cash flow to see if any consistent amount is coming. Moreover, the maintenance of everything is also important that shows the cash flows are whether certain or not. Before that, it is hard to say about the good and debt ratio. A lot of things are considered before making the final decision and that is also wrong in some cases.